Get Funded Faster.

The quickest development finance terms,

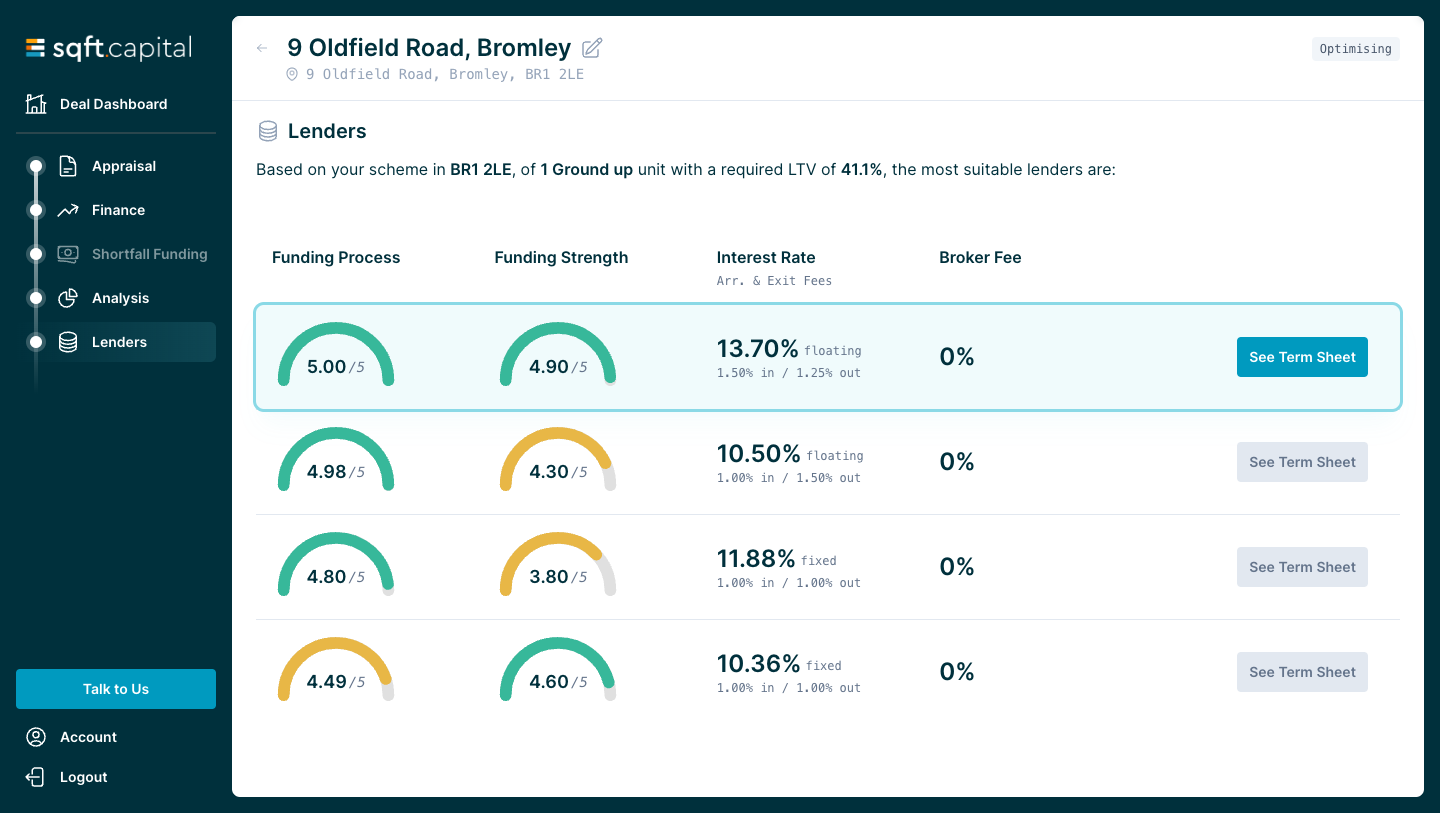

the most suitable lender,

in 3 minutes.

Trusted by the UKs leading housebuilders, developers and SME lenders.

Raising development finance is a slow process, with no way to compare lenders or pricing, and considerable uncertainty in funding.

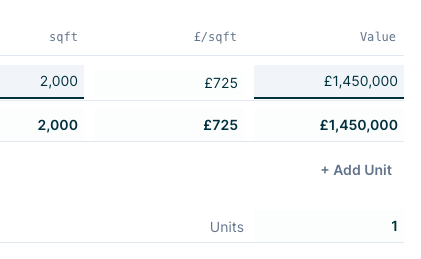

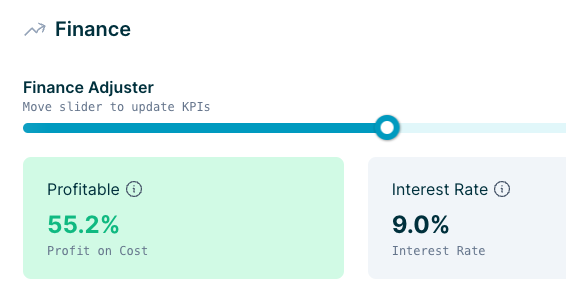

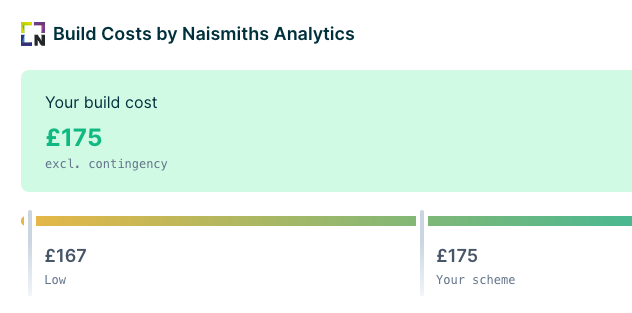

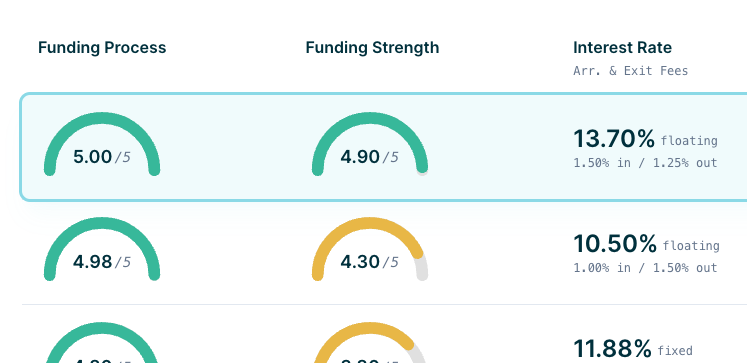

sqft.capital is a smart, easy-to-use platform that helps house-builders and developers get quicker, cheaper and more reliable access to the finance they need to build homes. It cuts through the traditional mess of brokers, spreadsheets, phone calls and delays — and replaces it with instant insight into what funding is available, from who, and on what terms. It’s quicker to get terms from a lender through sqft.capital, than going direct to the lender.

And it's free - we get paid by lenders.

A quicker, cheaper and more reliable way to raise development finance.

- Quicker.

- From appraisal to term sheet in 3 minutes.

A formal term sheet based on your scheme. - Cheaper.

- Free to use - onboarded lenders pay our fee, so no broker fee.

Optional closing fee of 0.5% - your choice. - More reliable.

- There are 230 market lenders, who each have about 30 lending parameters.

Humans / brokers cannot know this. Technology does.

Want to hear more?

Sign up to hear useful information on leading market rates and lenders deals.